S-Corporate Tax Form 1120-S is Due by

Friday, March 15, 2024.

Corporate Tax Form 1120 is Due by

Monday, April 15, 2024.

1120 Extension - Corporate Tax Extension

Form 7004

Here is the list of 1120 tax Forms that can extend the filing deadline using Form 7004.

| Form 1120 | Form 1120-C | Form 1120-F | Form 1120-FSC | Form 1120-H |

| Form 1120-L | Form 1120-ND | Form 1120-SF | Form 1120-PC | Form 1120-ND (Section 4951 taxes) |

| Form 1120-REIT | Form 1120-RIC | Form 1120-S | Form 1120-POL |

| Form 1120 | Form 1120-C |

| Form 1120-F | Form 1120-FSC |

| Form 1120-H | Form 1120-L |

| Form 1120-ND | Form 1120-SF |

| Form 1120-PC | Form 1120-ND (Section 4951 taxes) |

| Form 1120-REIT | Form 1120-RIC |

| Form 1120-S | Form 1120-POL |

Form 1120 Extension: Automatic Extension for

S-Corporations, and C-Corporations

S corporation tax returns

(Form 1120-S)

S corporations having December 31 as their year-end which coincides with the tax return due date of their owners, must file their Form 1120-S by March 15.

The 1120-S extension Form 7004 provides a 6-months extension to file your IRS income taxes. Most corporations operate on the calendar tax year. This means the original filing deadline is March 15, 2024, and the extended tax deadline is September 16, 2024.

C-Corporation tax returns

(Form 1120)

Corporation tax Form 1120 is due and payable on the 15th day of the fourth month after the end of the businesses fiscal year.

A corporation having December 31 as calendar tax year end, must file Form 1120 or extension form 7004 and pay tax due by April 15.

The manner in which you file a corporate tax extension is based on where you live. Various states typically have different tax laws and procedures, and you have to meet the particular tax agency’s requirements that govern your area.

In most cases, filing a corporate tax extension consists of filling out forms, providing a reasonable cause for the extension, and submitting the form to the tax agency. In many places, you also need to send a payment for your estimated taxes. If you do not send payment by the original IRS deadline, or your estimated payment is less than the amount you owe, you may face late fees and other penalties.

Automatic Extension up to 7-Months

Applicable for S-Corporations, C-Corporations and Other Businesses with the tax year ending on December 31 / with the tax year ending on any month except June 30.

*Automatic 7 months extension applicable for C-Corporation and other Entities with the tax year ending on June 30.

(6-months extension if filing Form 1120-POL).

How to complete 1120 Extension?

Form 7004 is used to extend the filing deadline for C-corporations, S-corporations, partnerships, and multiple-member LLCs filing as partnerships.

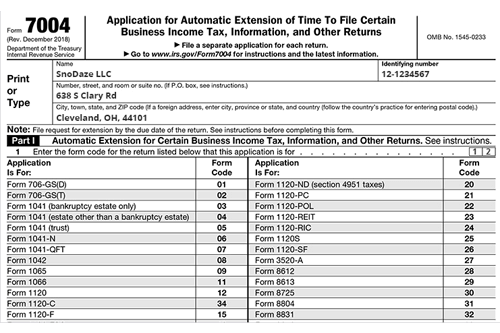

For filing Form 7004, you need to

- Enter Business Details such as Name, FEIN, and Address

- Choose the Form code for which the you are applying the extension

- Enter the tax year for which your corporate business operates on (Calendar/Fiscal)

- Enter Tentative tax and balance due

To know more about filing 1120 extension visit https://www.expressextension.com/

form7004extension/business-tax-extensions/

Click Here To Know More About Form 7004 Instructions.

Choose our Cloud Based Software to file 1120 Extension Online

- 1120extension.com is an IRS authorized e-file provider for filing 1120 tax extension forms.

- Our step-by-step filing process with clear guidance will help you to easily file your Form 7004 electronically with the IRS.

- Within a few minutes you'll be notified about the IRS approval status. In case, if your Extension is rejected you can re-transmit it for FREE.

Visit https://www.expressextension.com/ to know more about tax

extension solutions.

How to file 1120 extension Form Online using

our Software?

Create an Account

Choose Business Type & Form

Enter Tentative Tax Payment Details

Review your Form

Transmit your Form 7004 to the IRS

Pricing

E-file your 1120 extension Form 7004 for $19.95 per return

Extension Calculator for Tax Year 2023

Use this calculator to find your business income tax return deadline and its applicable extended deadline. Just choose your business type, and the form you use to report your taxes for the tax year.